-

Why Puerto Rico

-

How We Help

-

Key Sectors

-

About InvestPR

About InvestPR

-

News & Events

News & Events

X CLOSE

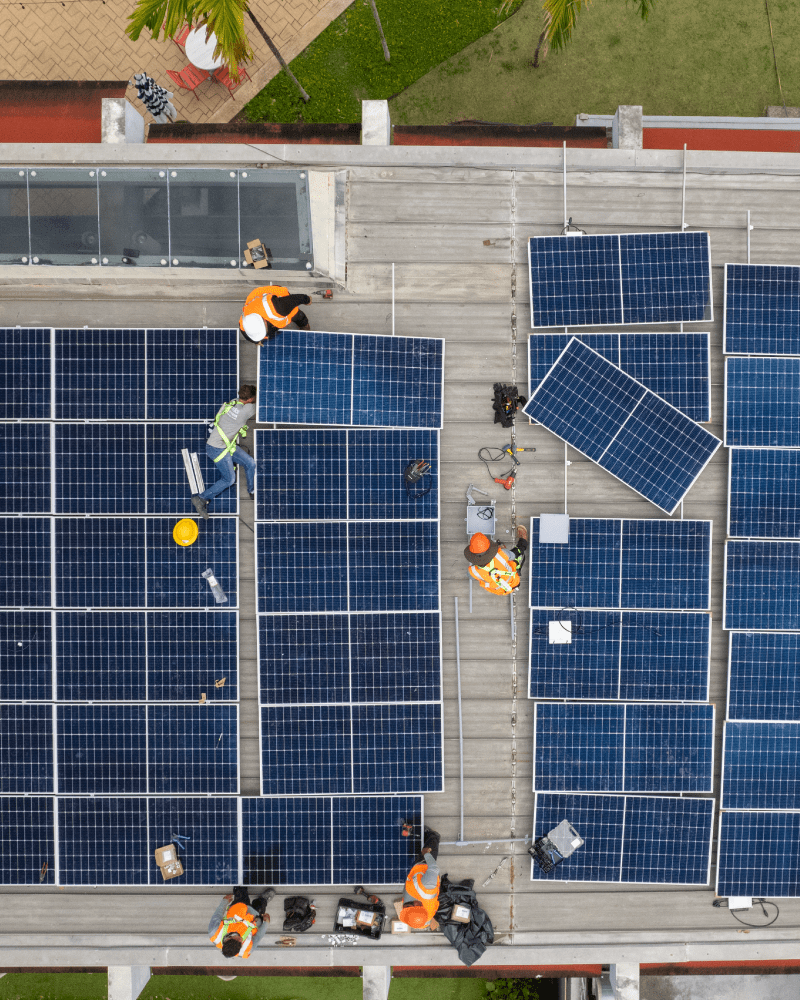

Puerto Rico is charting a sustainable path in the clean energy sector, establishing itself as a renewable energy hub. With a robust manufacturing sector and over $77 billion in federal funding post-Hurricane Maria focusing on renewable energy and grid modernization, the island is primed for innovation. An urgent demand for new energy solutions, a unique array of tax incentives for renewable energy, and strong support from local and international collaborations position Puerto Rico as a hotspot for investment in solar power and other renewable energy sources.

Puerto Rico’s energy landscape is backed by comprehensive institutional support and dynamic networking opportunities, establishing the island as a key hub and sector leader:

Puerto Rico Energy Bureau (PREB)

Genera Puerto Rico

LUMA Energy

Renewable Energy Contractors Association (ACONER, in Spanish)

Solar Energy and Storage Association (SESA)

Puerto Rico Electric Power Authority (AEE, in Spanish)

Puerto Rico Manufacturers Association (PRMA)

Puerto Rico is positioned as a leader in the renewable energy industry, with a focus on solar power. The island’s commitment to power energy transformation ensures a bright future for renewable energy and sustainable development. With investments in solar power in Puerto Rico and other renewable energy sources, the island is set to become a model for innovative and smart energy solutions.